Understanding Credit Basics |

|

| By: Veronica Balderas, Financial Coach | |

| April 1, 2025 | clock icon 6-minute read |

|

Understanding the different types of credit, how credit ratings work, and how to manage your credit is essential to reaching your financial goals. And what better time to learn about credit and take control of your financial well-being than National Financial Literacy Month? Let’s break down the basics of credit and set you up for success. What types of credit are there, and how are they used?

Its purpose is typically for credit or retail cards and home equity lines of credit (HELOCs). Keep in mind that your credit score is weighted heavily on how much of a balance you maintain on these.

What is a credit score? It’s a number formulated from information found on a credit report. Lenders use this and other information to determine if they should extend credit to you and at what interest rate. Knowing your credit score is crucial as it significantly affects major life decisions, such as taking out a loan to purchase a vehicle or home. What is considered a good credit score? There are different score models in which one lender may use a different model than another. However, a general range is anywhere between 300–850 and has five typical “rating tiers”:

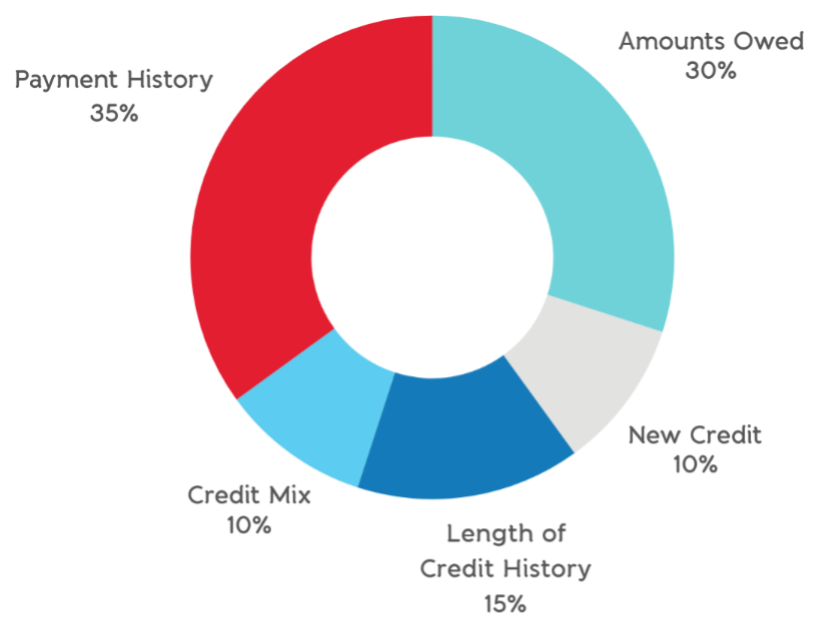

What affects your credit score? Your credit score is calculated by five categories with different weights of importance. Let’s learn about each. |

6 m inute read inute read |

What are some tips to manage or improve my credit score?

How can my credit profile help me reach my financial goals? Think of your credit profile as a report card of your credit history that lenders use (along with other information) to determine if they should extend credit to you and on what terms. For example, if you don’t have much credit history, but you’ve made on-time payments, lenders might decide to extend credit to you, but with a higher interest rate or a lower credit limit. Your approved interest rate and credit limit may influence your decisions when looking to make larger purchases like a mortgage, home improvements, and vehicles. With a little knowledge about your credit and routine monitoring, you may reach your financial goals sooner than you thought! Let’s start with a simple checklist to work on this month. |

|

Credit Checklist:

|

|

The bottom line is that credit should be part of your long-term financial goals, so spend this month familiarizing yourself with how credit works, where your credit stands, and how to use credit to meet your goals! And remember, if you need any guidance, make an appointment with our team of certificated Financial Coaches and they will be happy to help.

|

Veronica Balderas Financial Coach |

About the Author For the past five years, Veronica has provided members with the tools to create personalized financial plans that align with their goals. She offers information regarding budgeting, savings strategies, and spending plans to help members stay on track for long-term financial stability. Whether you're working to pay off debt, improve your credit score, or navigate a major financial change, Veronica provides practical advice. She focuses on building financial literacy and attacking complex challenges. Her hands-on approach ensures members are able to gain a better understanding of their finances and a clear plan for the future. |

|